41 zero coupon bond journal entry

Lifestyle | Daily Life | News | The Sydney Morning Herald The latest Lifestyle | Daily Life news, tips, opinion and advice from The Sydney Morning Herald covering life and relationships, beauty, fashion, health & wellbeing Zero Coupon Bond Questions and Answers | Homework.Study.com Access the answers to hundreds of Zero-coupon bond questions that are explained in a way that's easy for you to understand. ... $50,000 one year bond, at 10% bonds to yield an issue price of $52,000. What would be the amount needed to record as a journal entry as a credit to Bonds Payable? View Answer. Pinder Co. produces and sells high-quality ...

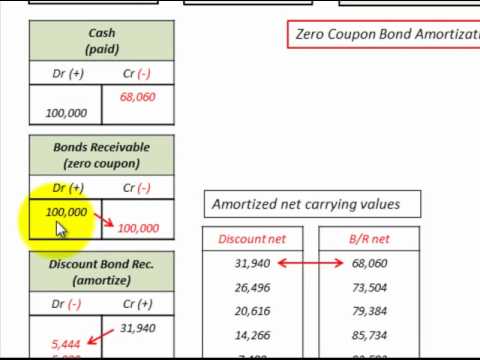

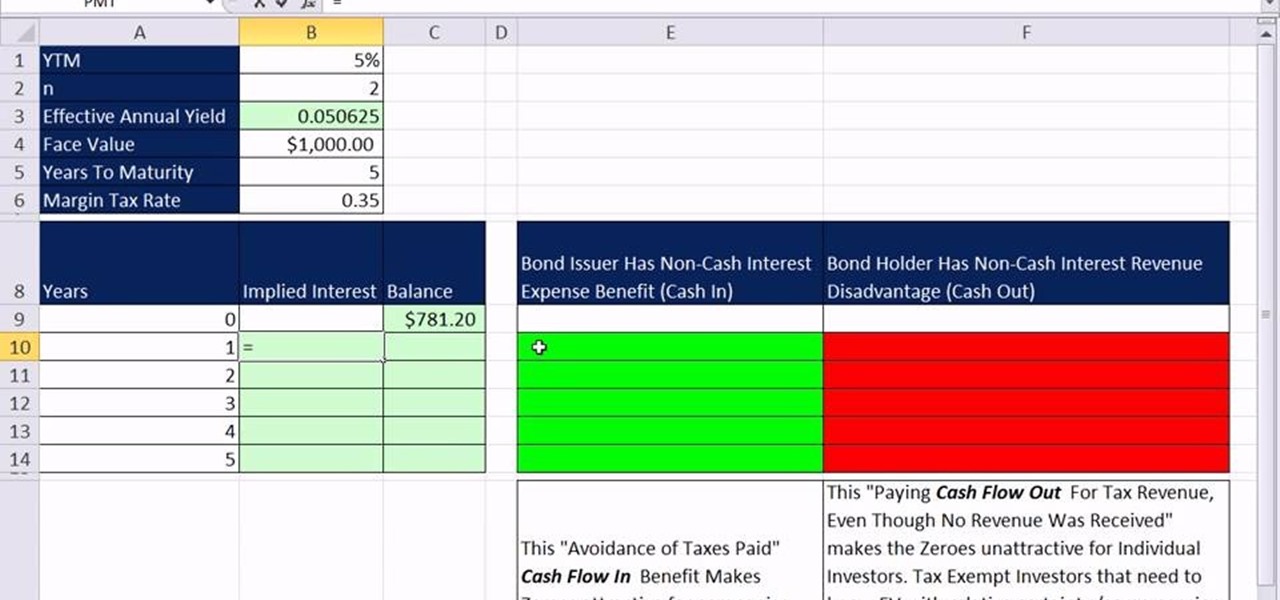

Zero Coupon Bond Issued At Discount Amortization And Accounting Journal ... accounting for a zero coupon bond issued at a discount (issue price less than face value) interest calculation and balance sheet recording, start with a cash flow diagram, face (maturity) value,...

Zero coupon bond journal entry

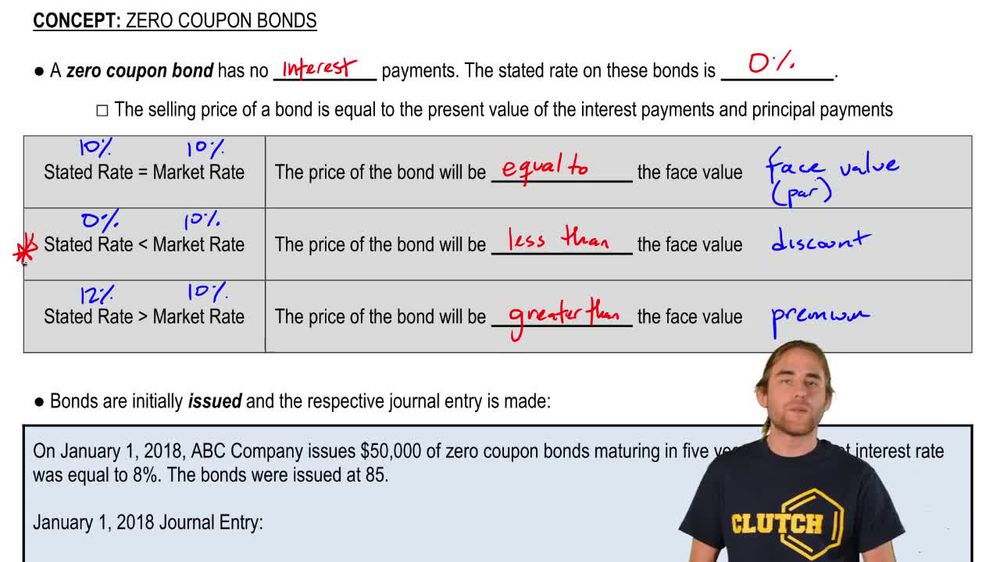

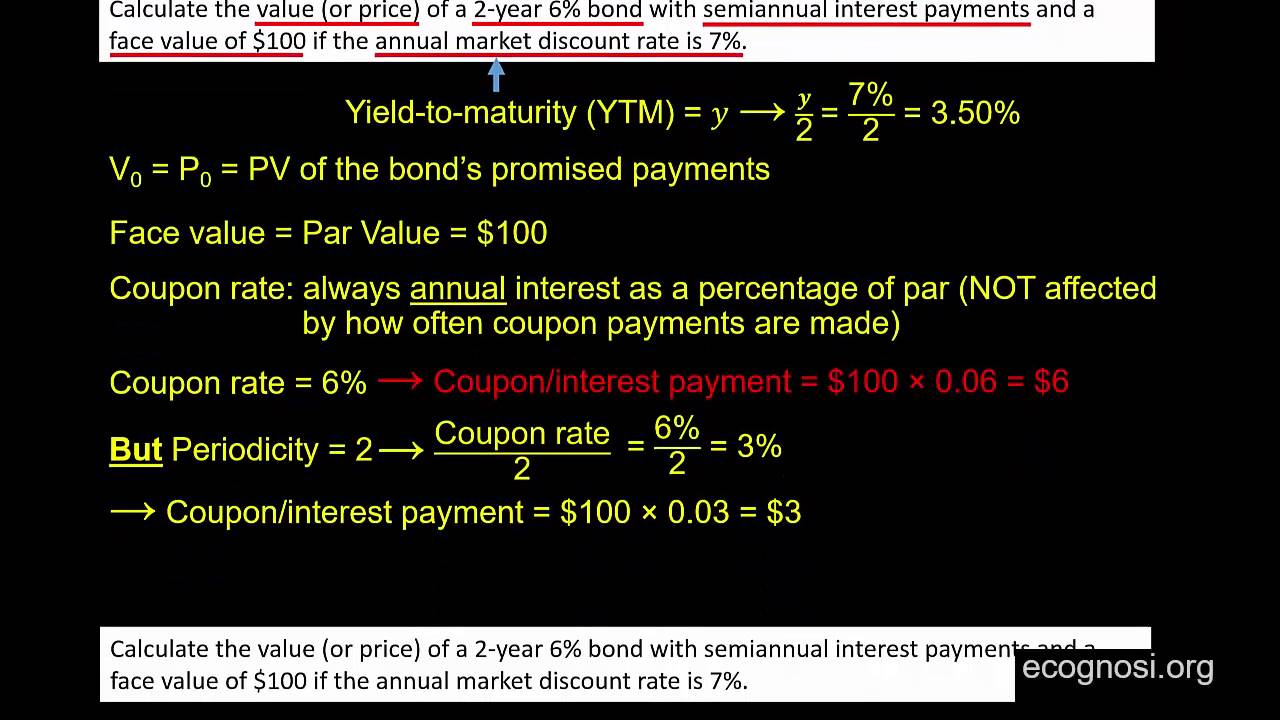

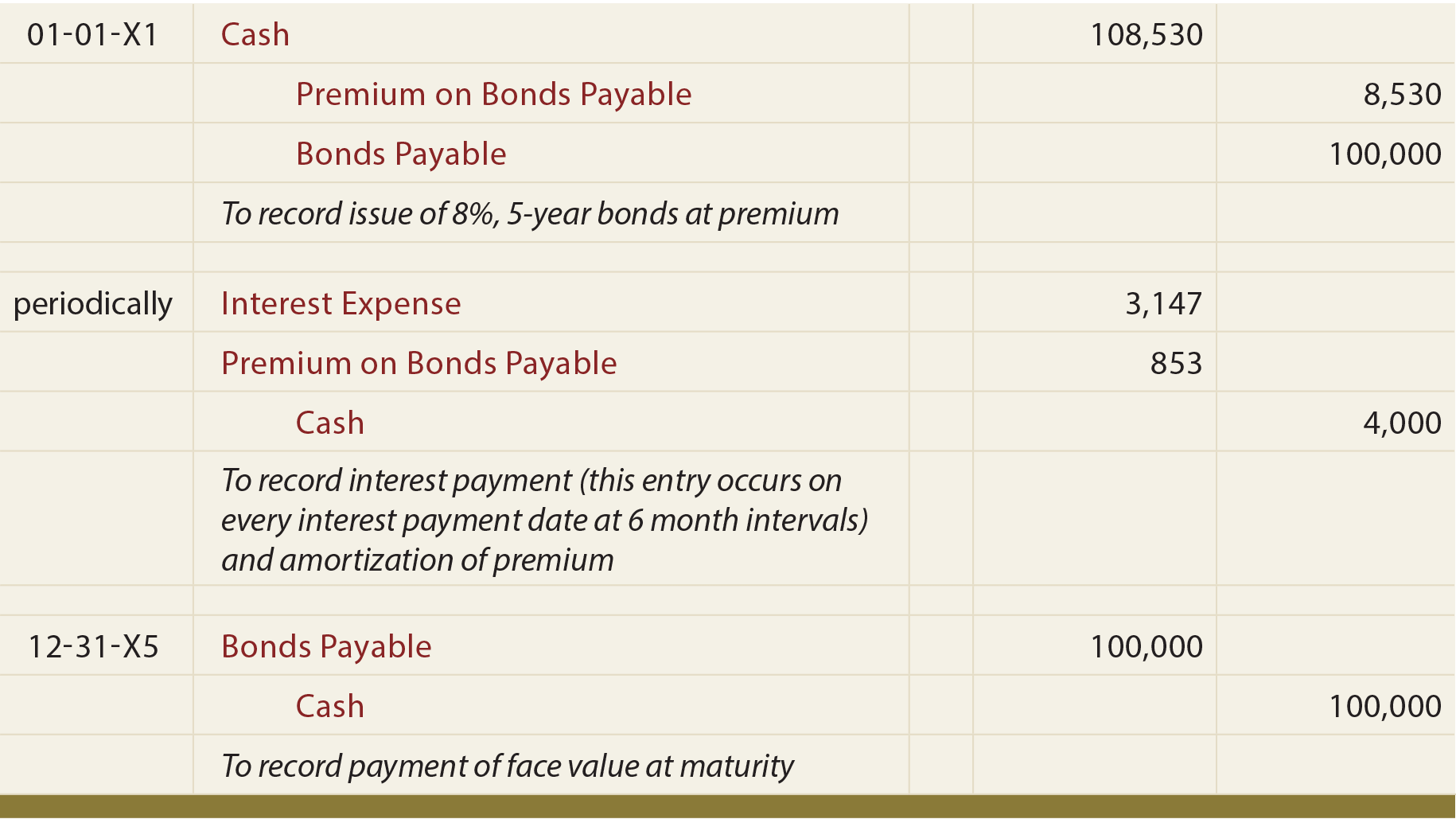

Learn About Zero Coupon Bond | Chegg.com A zero-coupon bond is a debt security that sells without an expressed coupon rate. These bonds are sold at deep discounts and do not pay monthly interest as typical bonds do.This way, the bond issuer does not need to worry about interest rate changes, and the investors receive a lump sum amount at maturity rather than regular coupon interest.. Bond issuers give out bonds to finance their long ... What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond is a discounted investment that can help you save for a specific future goal. Tara Mastroeni. Updated. Jul 28, 2022, 9:13 AM. Buying zero-coupon bonds can be a good deal for ... Bonds Payable | Journal Entries | Examples - XPLAIND.com Example: Journal Entries. On 1 January 2001, Codestreet, Inc. issued 100,000, $100 face value bonds carrying a coupon rate of 8% payable semiannually. The term of the bonds is 20 years. Journalize issuance of bonds and the first semi-annual payment. Solution.

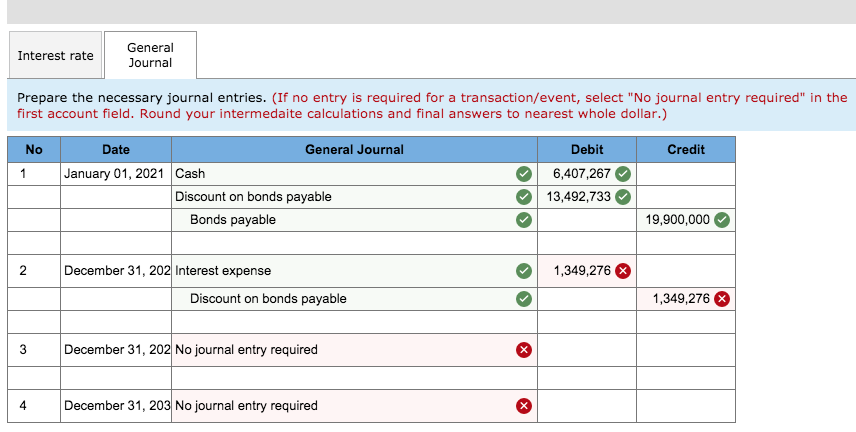

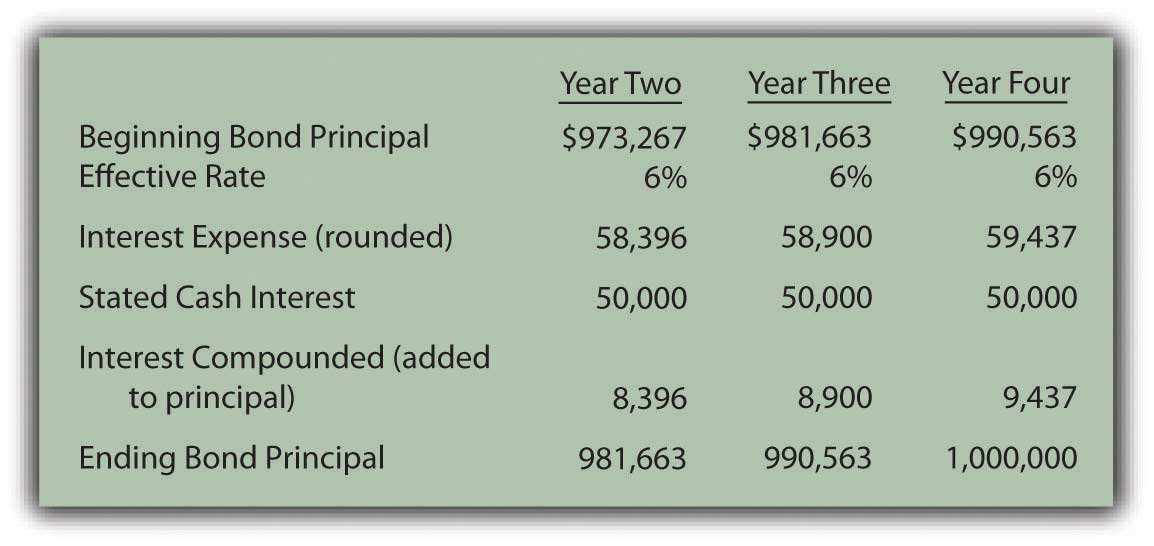

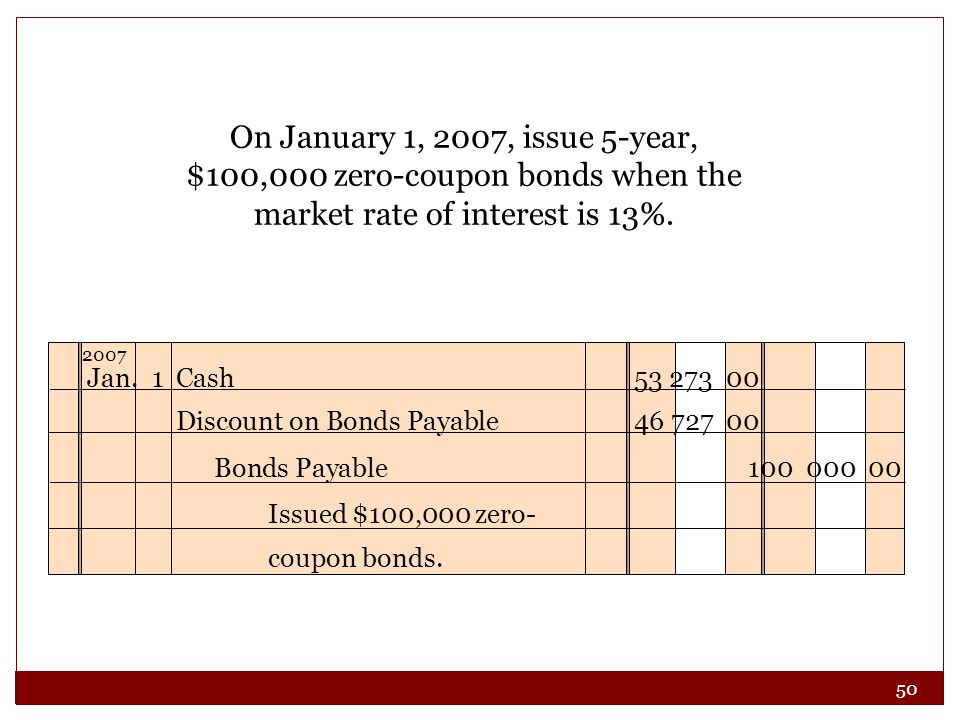

Zero coupon bond journal entry. Accounting for Zero-Coupon Bonds - XPLAIND.com A zero-coupon bond is a bond which does not pay any periodic interest but whose total return results from the difference between its issuance price and maturity value. For example, if Company Z issues 1 million bonds of $1000 face value bonds due to maturity in 5 years but which do not pay any interest, it is a zero-coupon bond. Accounting for Zero-Coupon Bonds - Lardbucket.org The entry shown in Figure 14.8 "January 1, Year One—Zero-Coupon Bond Issued at Effective Annual Interest Rate of 6 Percent" can also be recorded in a slightly different manner. Under this alternative, the liability is entered into the records at its face value of $20,000 along with a separate discount of $2,200. Bond Discount Amortization | Journal Entries & Example Oct 31, 2020 · Total bond liability equals $10 million i.e. the product of 10,000 number of bond and the bond face value of $1,000. Because actual cash proceeds are $9,852,591, the bank is debited by this amount and the balancing figure is attributable to bond discount. Journal Entry for Zero Coupon Bonds | Accounting Education Now, we are ready to pass the journal entries of zero coupon bonds. For example, A company issues $ 20,000 zero coupon bond in the market. Mr. David bought it at the discount of $ 3471. It means Mr. David bought it at $ 16529 at 10% per year his earning. At the end of second year, company has to pay only face value of $ 20000.

Zero Coupon Bonds's Journal Entries | Svtuition Zero Coupon Bonds's Journal Entries Journal Entries of Zero Coupon Bonds Watch on Zero coupon bonds are the famous type of bonds in which the company will gives only face value without paying any extra discount. Investor gets earning buy getting the zero coupon bonds at discount. How to Calculate a Zero Coupon Bond Price | Double Entry ... Jul 16, 2019 · n = 3 i = 10% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 10%) 3 Zero coupon bond price = 751.31 (rounded to 751) As the face value paid at the maturity date remains the same (1,000), the price investors are willing to pay to buy the zero coupon bonds must fall from 816 to ... How Do Zero Coupon Bonds Work? - SmartAsset A zero coupon bond doesn't pay interest, but it could pay off for your portfolio. Choosing between the many different types of bonds may require a plan for your broader investments. A zero coupon bond often requires less money up front than other bonds. Yet zero coupon bonds still carry some of risk and can still be influenced by interest rates. Zero Coupon Bond | Investor.gov The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years. These long-term maturity dates allow an investor to plan for a long-range goal, such as paying for a child's college education. With the deep discount, an investor can put up a small amount of money that can grow over many years.

Home | NextAdvisor with TIME const FP = {“featured_posts_nonce”:”c89c3705e6″,”featured_posts”:[{“description”:”How these Latinx and Black founders leveraged their stories to put ... What Is a Zero-Coupon Bond? - Investopedia The price of a zero-coupon bond can be calculated as: Price = M ÷ (1 + r) n where: M = Maturity value or face value of the bond r = required rate of interest n = number of years until maturity... Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond. Journal Entry for Bonds - Accounting Hub The total discount on bonds payable at the maturity date as a result of the journal entry for each periodic payment above will be zero. At the maturity date, the journal entry for the repayment of discount bonds is as follow: Journal Entry for Bond Issued at Premium

Journal entry for zero coupon bond - Accountinginside Issuing zero coupon bonds: In this journal entry, the bond discount account is a contra account to the bonds payable on the balance sheet, and the amount of bonds payable here is the face value of the zero coupon bonds. Likewise, the carrying value of the bonds payable on the balance sheet is the bonds payable less the bond discount.

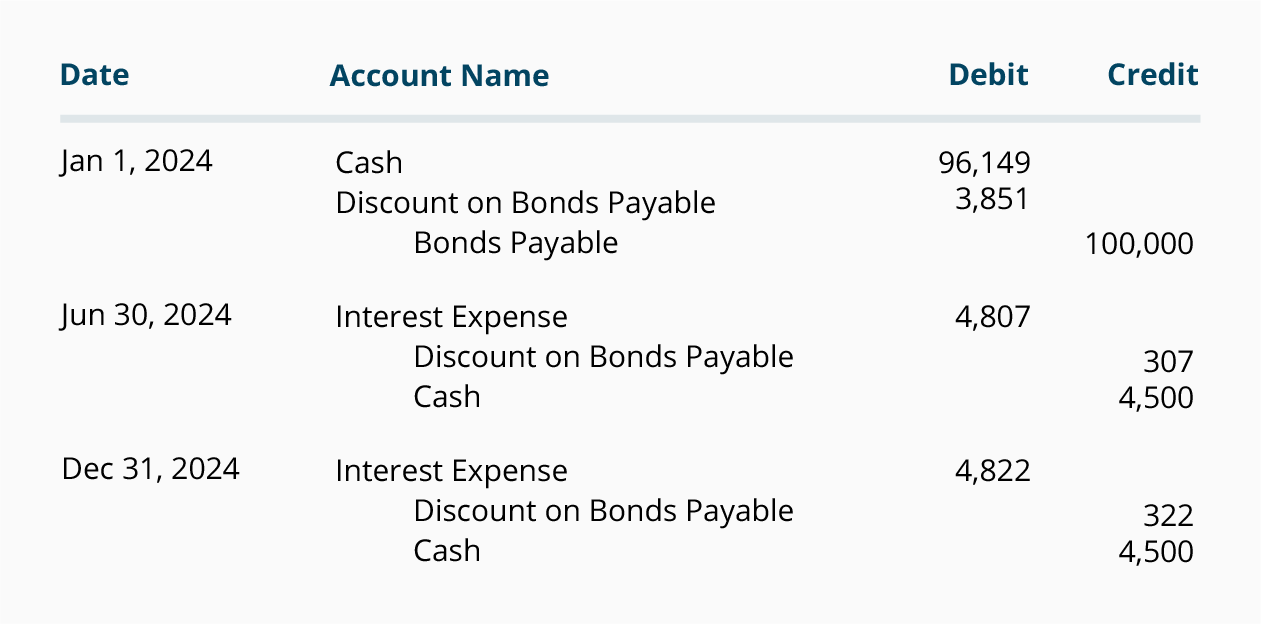

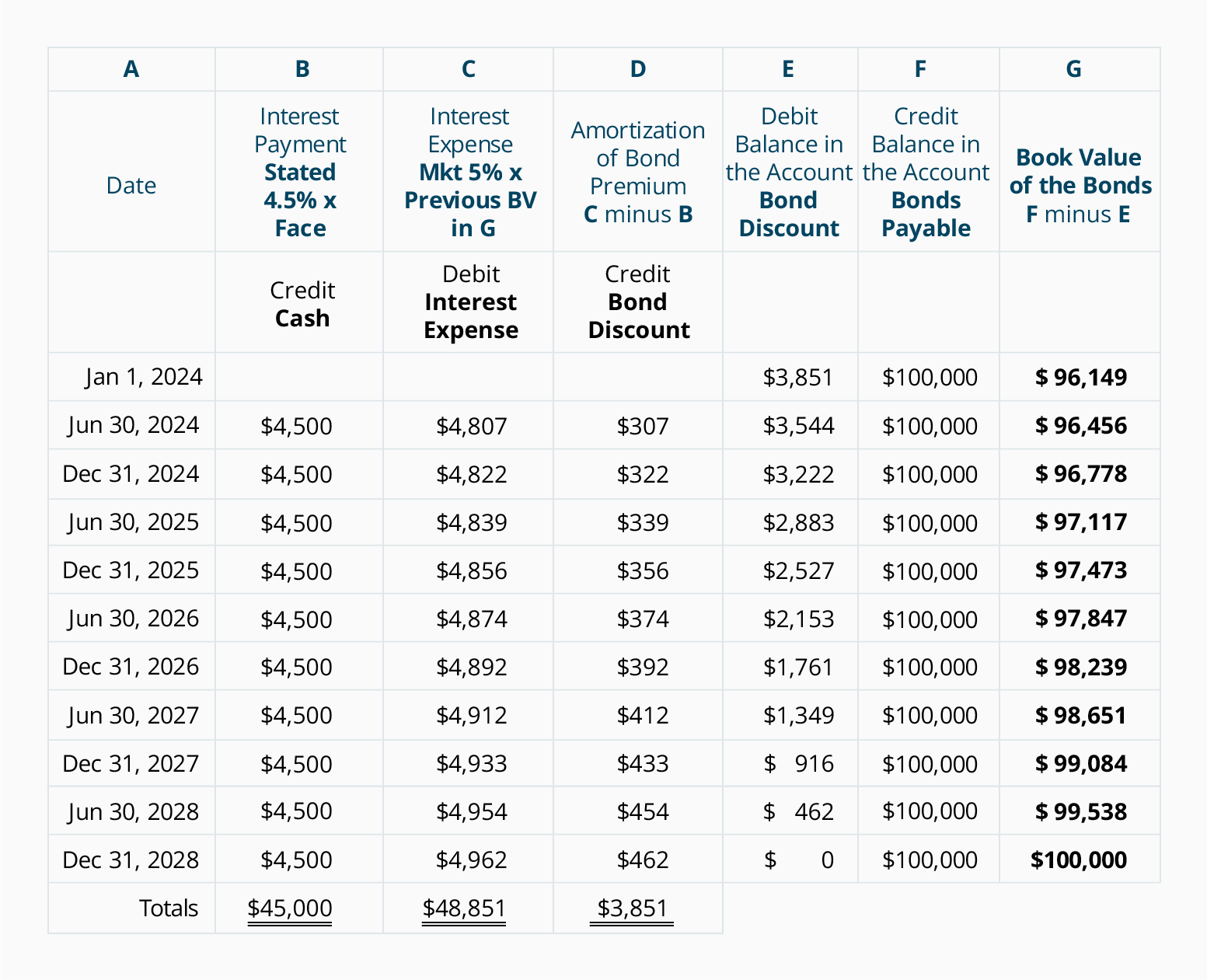

Bond Discount Journal Entry | Example - Accountinginside Bond discount example. For example, on February 1, the company ABC issues a $100,000 bond with a five-year period at a discount which it sells for $97,000 only. The bond gives an 8% interest which is payable annually on February 1. In this case, the company ABC can make the bond discount journal entry on February 1, when it issues the bond at a ...

Autoblog Sitemap 2022 BMW 3.0 CSL is a manual, rear-wheel-drive throwback to the 1970s

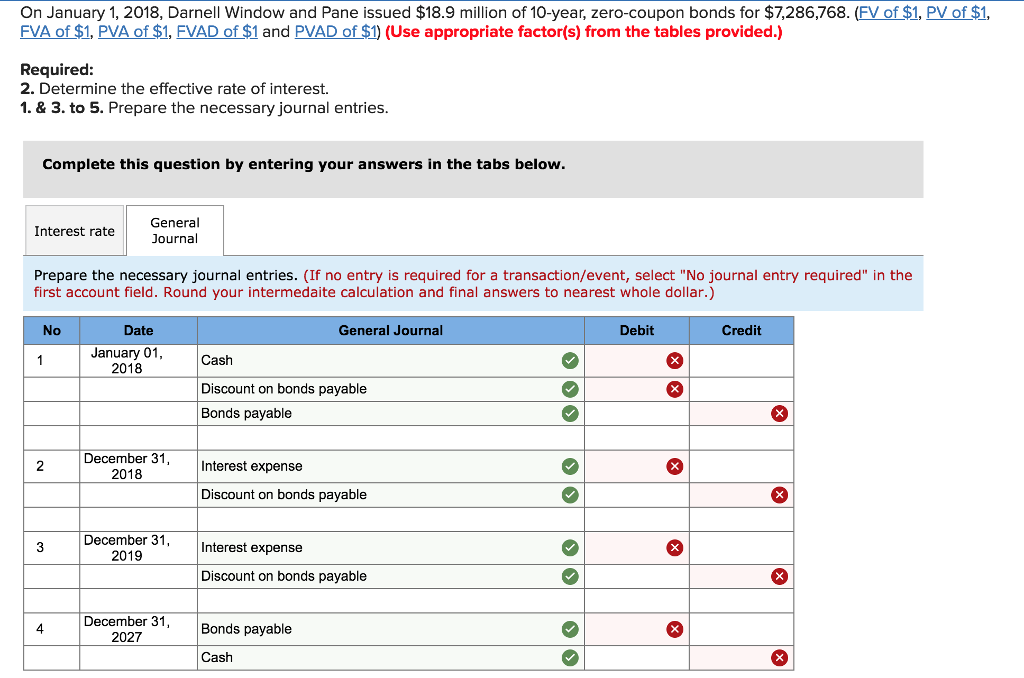

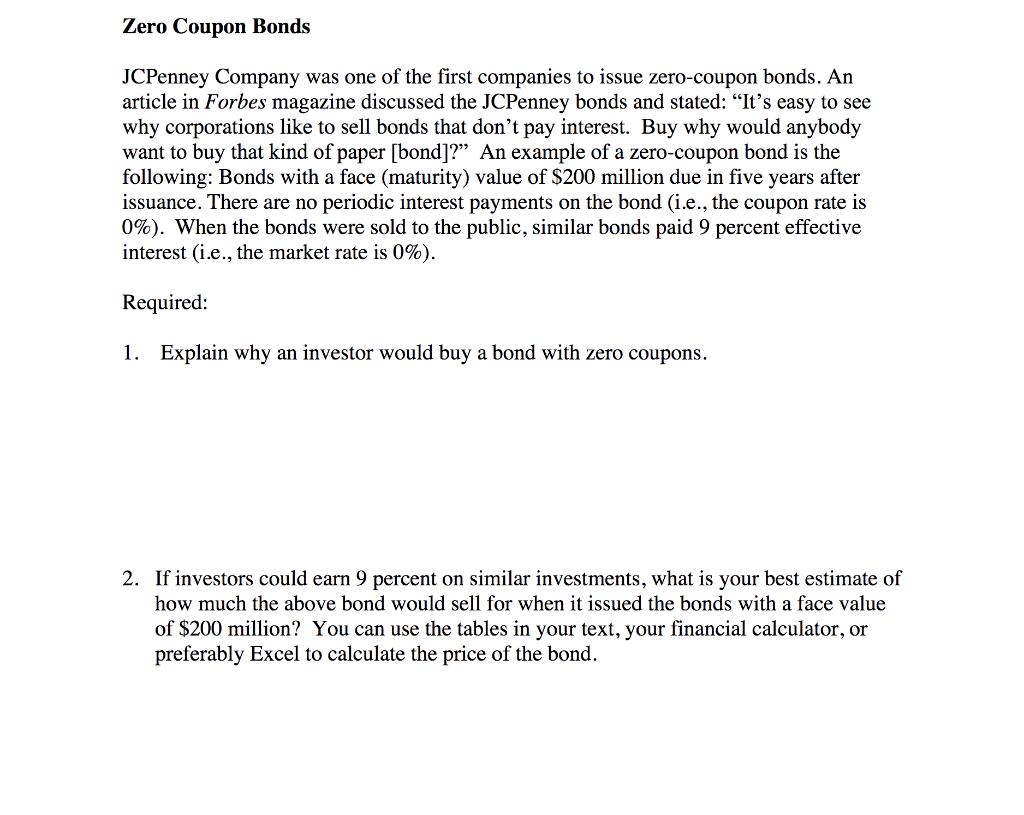

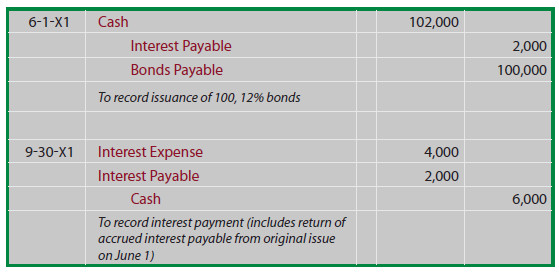

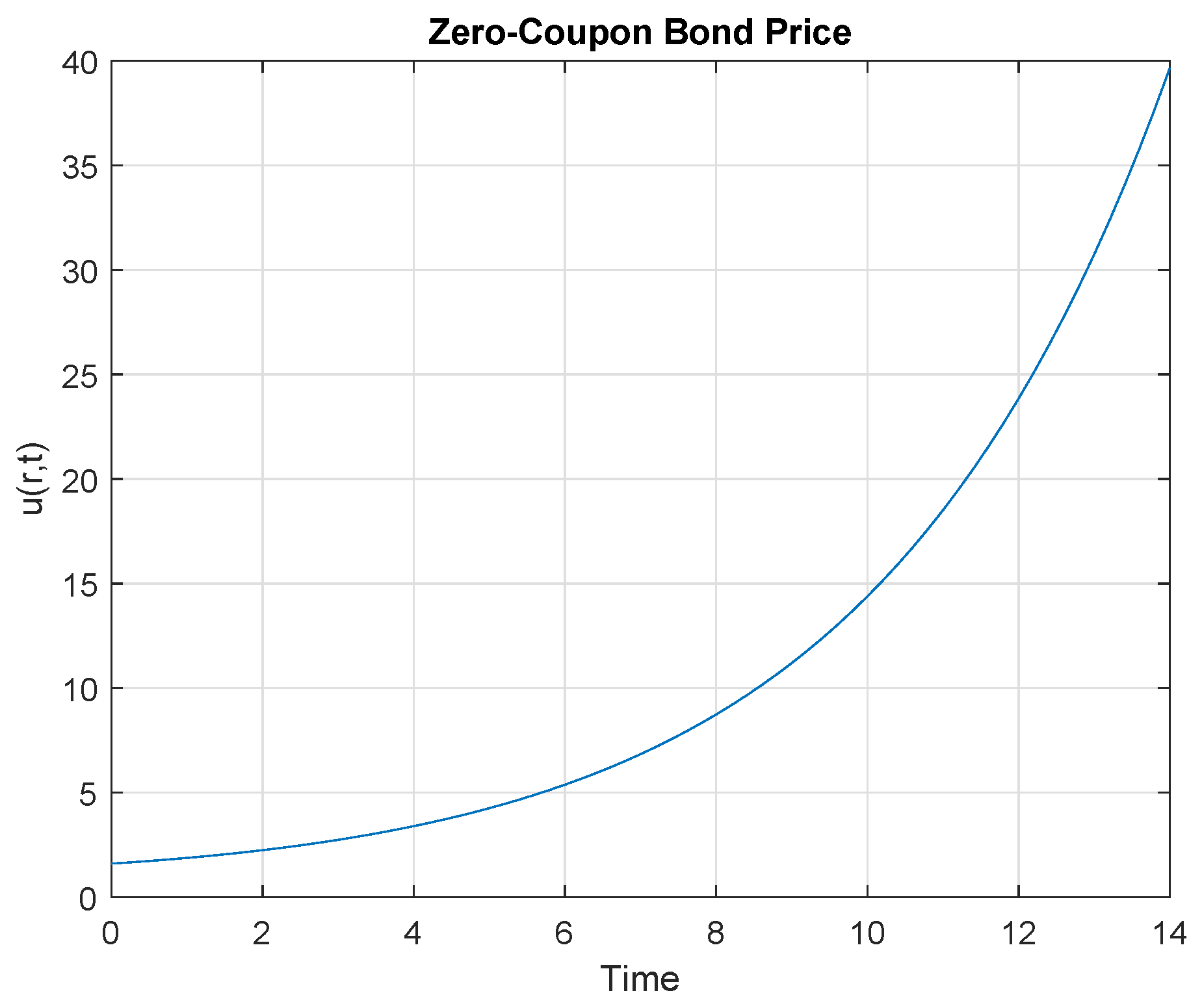

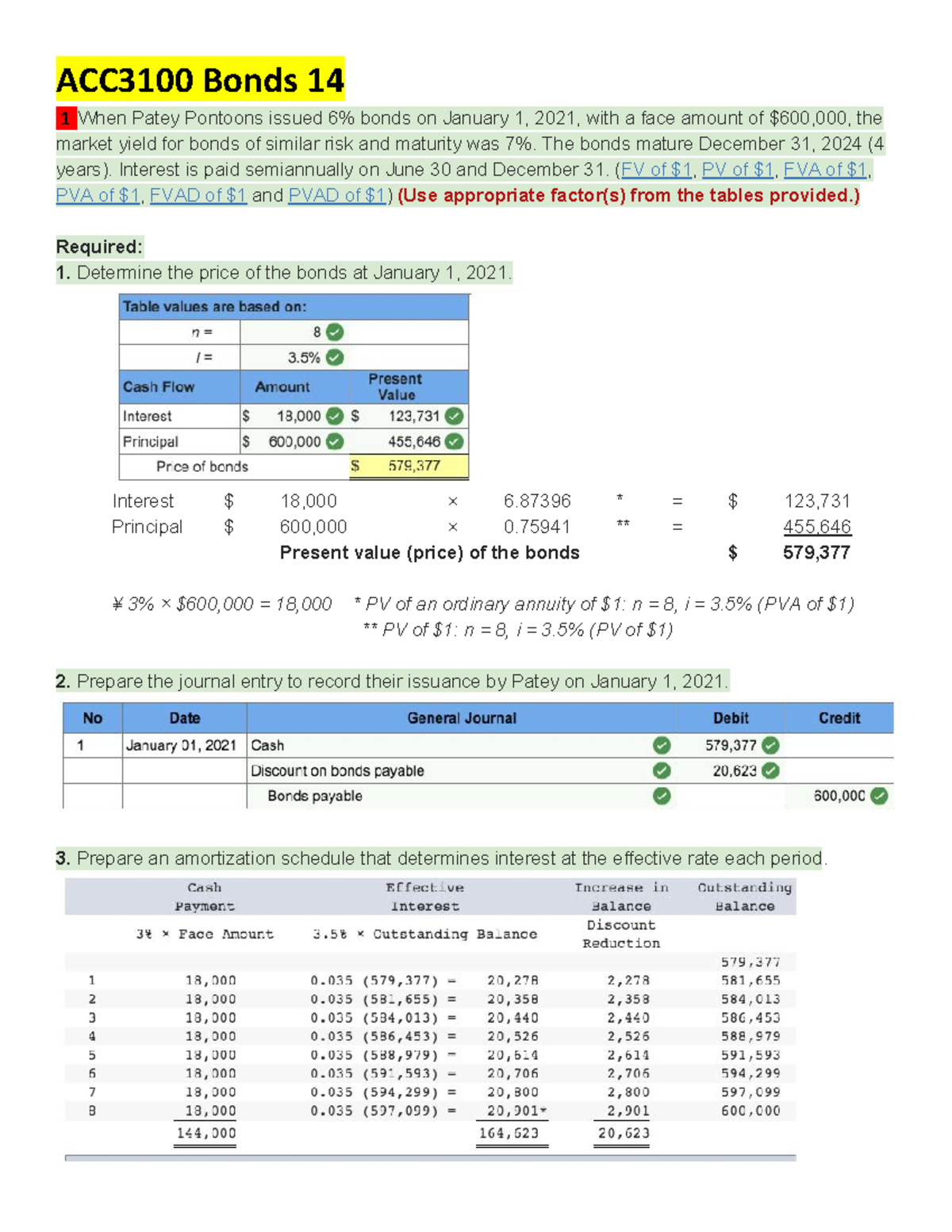

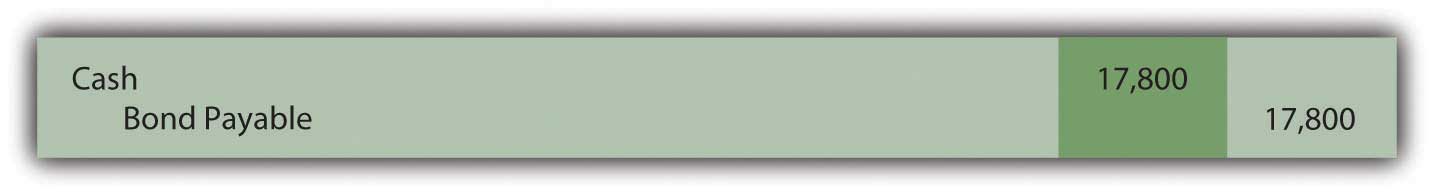

14.3 Accounting for Zero-Coupon Bonds - Financial Accounting Question: This $20,000 zero-coupon bond is issued for $17,800 so that a 6 percent annual interest rate will be earned. As shown in the above journal entry, the bond is initially recorded at this principal amount. Subsequently, two problems must be addressed by the accountant. First, the company will actually have to pay $20,000.

Accounting for Zero-Coupon Bonds - GitHub Pages Question: This $20,000 zero-coupon bond is issued for $17,800 so that a 6 percent annual interest rate will be earned. As shown in the above journal entry, the bond is initially recorded at this principal amount. Subsequently, two problems must be addressed by the accountant. First, the company will actually have to pay $20,000.

Zero-Coupon Bond - Definition, How It Works, Formula Example of a Zero-Coupon Bonds Example 1: Annual Compounding John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53

Zero-Coupon Bonds: Characteristics and Calculation - Wall Street Prep Zero-coupon bonds, also known as "discount bonds," are sold by the issuer at a price lower than the face (par) value that is repaid at maturity. If Price > 100 "Premium" (Trading Above Par) If Price = 100 "Par" (Trading at Par Value) If Price < 100 "Discount" (Trading Below Par)

Journal Entries of Zero Coupon Bonds - YouTube Investor gets earning buy getting the zero coupon bonds at discount. This discount will be the income of investor and second side, company has to show it as interest which not in cash but it...

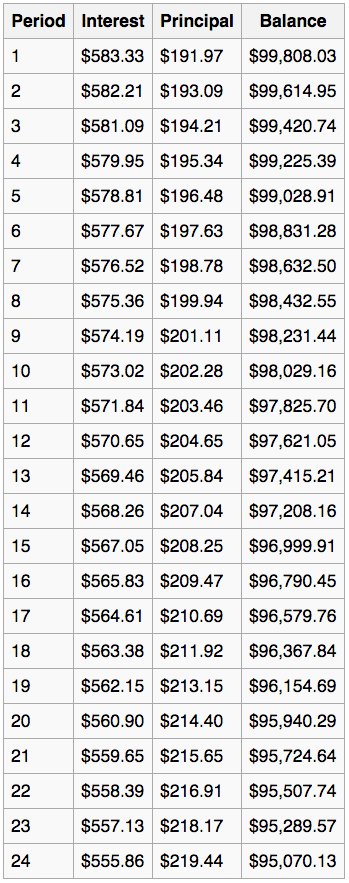

Mortgage-backed security - Wikipedia Just as this article describes a bond as a 30-year bond with 6% coupon rate, this article describes a pass-through MBS as a $3 billion pass-through with 6% pass-through rate, a 6.5% WAC, and 340-month WAM. The pass-through rate is different from the WAC; it is the rate that the investor would receive if he/she held this pass-through MBS, and ...

Zero Coupon Bonds Journal Entries - bizimkonak.com Journal Entry for Zero Coupon Bonds Accounting Education. CODES (4 days ago) Now, we are ready to pass the journal entries of zero coupon bonds. For example, A company issues $ 20,000 zero coupon bond in the market. Mr. David bought it at the discount of $ … Visit URL. Category: coupon codes Show All Coupons

United States Treasury security - Wikipedia Treasury bonds (T-bonds, also called a long bond) have the longest maturity at twenty or thirty years. They have a coupon payment every six months like T-notes.. The U.S. federal government suspended issuing 30-year Treasury bonds for four years from February 18, 2002, to February 9, 2006.

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon bonds are also appealing for investors who wish to pass wealth on to their heirs but are concerned about income taxes or gift taxes. If a zero-coupon bond is purchased for...

Zero Interest Bonds | Formula | Example | Journal Entry - Accountinguide Please prepare the journal entry during issuing and the annual interest expense. As the company issue bonds at zero interest rate, we need to calculate the selling price first. Selling price = $ 100/ (1+6%)^5 = $ 74.72 Company needs to sell bonds at $ 74.72 per bond. So the company will receive the cash of $ 74,270 for selling 1,000 bonds.

Accounting Deep Discount Bonds - I GAAP & IFRS - CAclubindia A. Zero Coupon Bond (Deep Discount Bond) Zero-coupon bond (also called a discount bond or deep discount bond) is a bond issued at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments, or have so-called "coupons," hence the term zero-coupon bond.

Deferred Coupon Bond | Formula | Journal Entry - Accountinguide Company issue 1,000 zero-coupon bonds with a par value of $ 5,000 each. As the bonds do not provide any annual interest to the investors, so they have to be discounted and pay back the full value of par value. The market rate is 5% and the term of the bonds is 4 years. ... Deferred Coupon Bond Journal Entry. Account Debit Credit;

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Zeros, as they are sometimes called, are bonds that pay no coupon or interest payment. will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond ...

Bonds Payable | Journal Entries | Examples - XPLAIND.com Example: Journal Entries. On 1 January 2001, Codestreet, Inc. issued 100,000, $100 face value bonds carrying a coupon rate of 8% payable semiannually. The term of the bonds is 20 years. Journalize issuance of bonds and the first semi-annual payment. Solution.

What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond is a discounted investment that can help you save for a specific future goal. Tara Mastroeni. Updated. Jul 28, 2022, 9:13 AM. Buying zero-coupon bonds can be a good deal for ...

Learn About Zero Coupon Bond | Chegg.com A zero-coupon bond is a debt security that sells without an expressed coupon rate. These bonds are sold at deep discounts and do not pay monthly interest as typical bonds do.This way, the bond issuer does not need to worry about interest rate changes, and the investors receive a lump sum amount at maturity rather than regular coupon interest.. Bond issuers give out bonds to finance their long ...

![Solved Problem 14-9 Zero-coupon bonds [LO14-2] On January 1 ...](https://media.cheggcdn.com/media%2Fbdc%2Fbdc593f0-51e5-4be8-a252-f0a0f6e3f532%2FphpbOFNK4.png)

Post a Comment for "41 zero coupon bond journal entry"